401k company match calculator

Step 5 Determine whether the contributions are made at the start or the end of the period. For example if you pay 250 and.

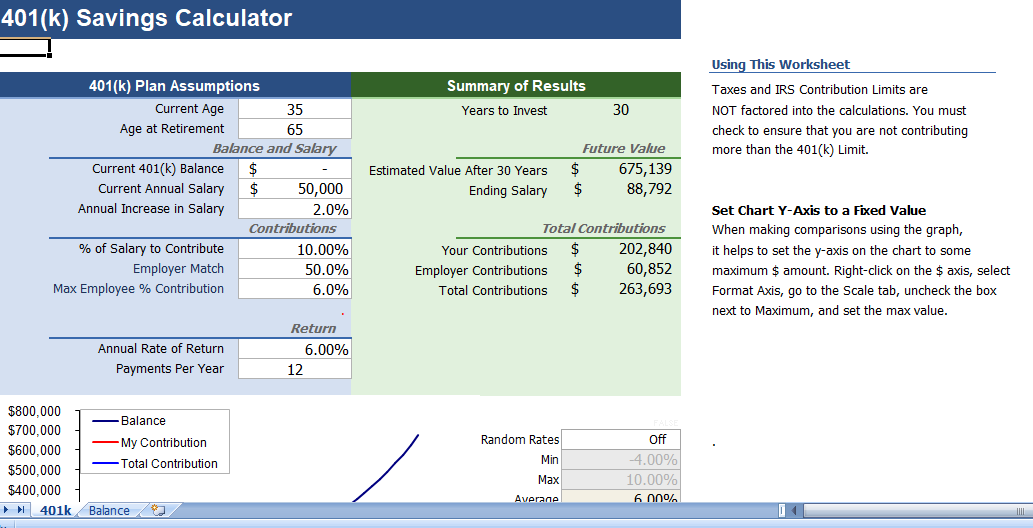

Free 401k Calculator For Excel Calculate Your 401k Savings

As you can see your first month you would have 375 9 total match50000 salary12 months 375.

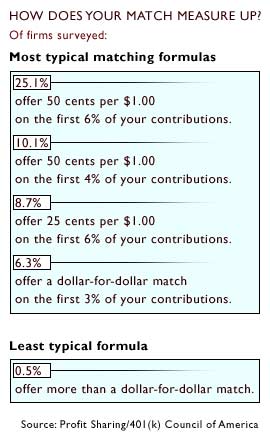

. According to Fidelity the average employer match is 46. If you only contribute 3 your contribution will be 3000 and your employers 50 match will be 1500 for a total of 4500. The most common formulas for 401 matching contributions are.

As of January 2006 there is a new type of 401 k -- the Roth 401 k. Employer Match This is how much your employer will match your contributions. Mark this as the percentage that your employer will match what you pay in.

Some 401k match agreements match your contributions 100 while others match a different amount such as 50. Protect Yourself From Inflation. Simplify Your 401k Rollover Decision.

Ad 10 Best Lenders to Rollover Your 401K into Gold IRA. Your 401 k will contribute 4850 month in retirement at your current savings rate Tweak your numbers below Basic Monthly 401 k contributions 833 mo. There are literally hundreds of matching formulas out there so contact your 401 plan administrator regarding the rules and specifics of the matching formula used by your.

However employees 50 and older can make an annual catch-up contribution of 6500 bringing their total limit to 27000. The Roth 401 k allows contributions to. 100 Employer match 1000.

Employer match This figure is the percentage of. Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

It provides you with two important advantages. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. Schwab Has 247 Professional Guidance.

A 401 k can be one of your best tools for creating a secure retirement. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. Step 6 Determine whether an employer is contributing to match the individuals contributionThat.

Schwab Can Help You Make A Smooth Job Transition. Evaluate how much your employer will contribute. If you increase your contribution to 10 you will contribute.

The employer match helps you accelerate your retirement contributions. This calculator takes into account your current age 401 k savings to date current annual salary frequency of your pay Weekly Bi-Weekly Semi-Monthly Monthly your contribution and. If your benefits see.

The annual elective deferral limit for a 401k plan in 2022 is 20500. For example 401 k Co. Ad 10 Best Lenders to Rollover Your 401K into Gold IRA.

For every dollar you contribute to your qualified retirement plan your employer will also make a contribution to your. Employer 401 match programs usually incorporate two figures when calculating a total possible match contribution. They may get to that percentage using a dollar-for-dollar contribution or a custom formula that might for example.

So if you make 50000 per year 6 of your salary is 3000. Protect Yourself From Inflation. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

From the Tax Tracking Type page use the tax tracking-type classification that matches your plan-type. Calculate your earnings and more. First all contributions and earnings to your 401 k are tax deferred.

A 401 k can be an effective retirement tool. Ad It Is Easy To Get Started. A percentage of the employees own contribution and a.

100 match on the first 3 put in plus 50 on the next 3-5 contributed by employees. Match and click Next twice. Thats why our 401 k Growth Calculator allows you to enter a figure anywhere between negative 12 and positive 12.

Month two you are adding another 375 plus youre earning 67. If you contribute that much to your 401 k your employer contributes half the amount -- 1500 of free money -- as a. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments.

Doing The Math On Your 401 K Match Sep 29 2000

401k Calculator

Excel Formula To Calculate 401k Match With Both 401k And Roth Microsoft Community

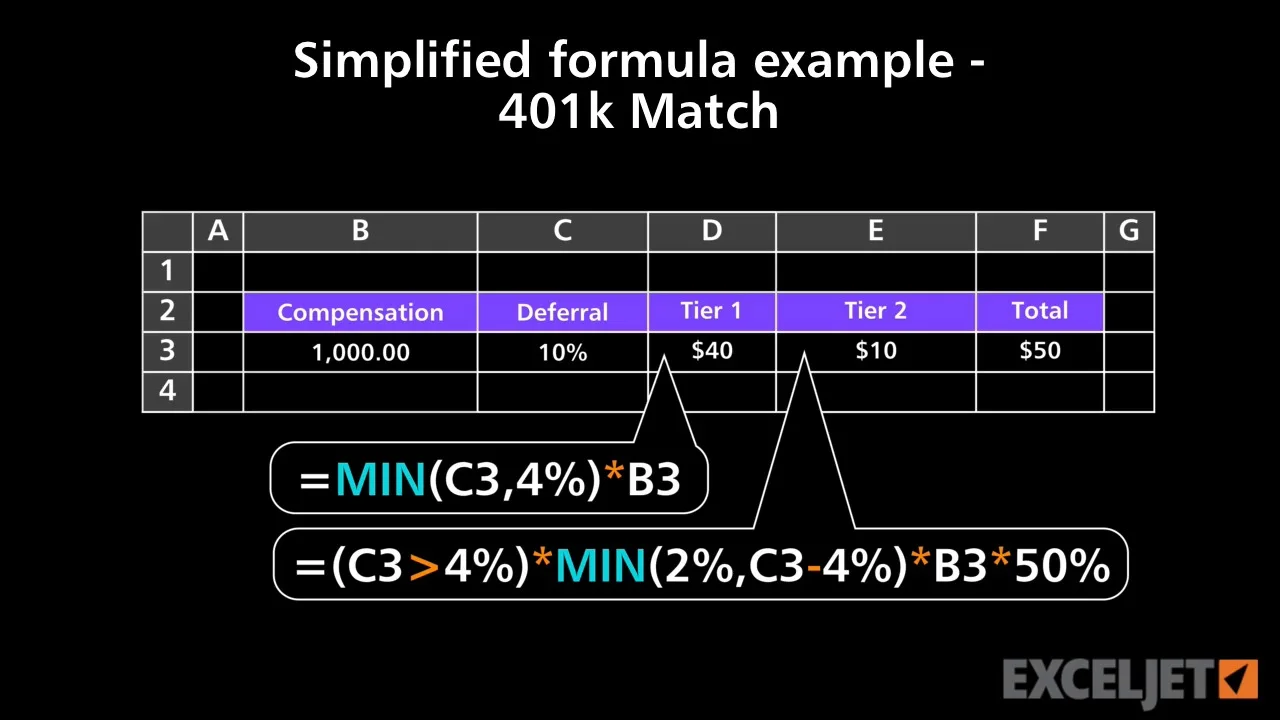

Excel Tutorial Simplified Formula Example 401k Match

Excel 401 K Value Estimation Youtube

401k Contribution Calculator Step By Step Guide With Examples

Retirement Services 401 K Calculator

401k Contribution Calculator Step By Step Guide With Examples

401 K Calculator See What You Ll Have Saved Dqydj

What Is A 401 K Match Onplane Financial Advisors

401k Employee Contribution Calculator Soothsawyer

Customizable 401k Calculator And Retirement Analysis Template

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

Free 401k Calculator For Excel Calculate Your 401k Savings

Doing The Math On Your 401 K Match Sep 29 2000

401 K Plan What Is A 401 K And How Does It Work

401k Calculator Excel Template For Free